There were some forex trading strategies that I came across wherein they were enforcing never to use 'stop loss'. In the first place, I also thought that trading without a stop loss can be profitable as the trend always goes back and forth but I was wrong. A trade can never go back that if you haven't placed any stop loss, your position will keep on accumulating more losses that you can never imagine.

Here are the two forex trading strategies that I came across that doesn't require stop loss:

1. Perfect Hedging Strategy

Perfect hedging strategy is an old method where it requires two different brokers. The first broker must be paying high-interest for keeping your position overnight. While the second broker, it does not charge or pay interest.

What you have to do is to open the currency that pays huge interest on your first broker. This is where your profit will be coming from. On the second method, open the opposite order of the currency that you have opened on your first broker. This will negate your losses.

This method require huge amount of capital and there are only few brokers that features free-interest. Other than that, brokers are now aware of this strategy that when you are caught using it they might close your account.

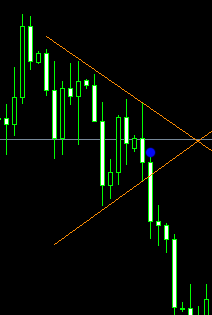

2. Grid Trading Strategy

Grid trading is a strategy where the method is to setup multiple orders on different levels of prices. As an example you will be setting up pending orders with distant prices of 10, 20, 30 and so on... Since the forex market always moves back and fort - chances are, some of those triggered orders will be in profit. All you have to do is to re-setup all orders that has triggered their target profit.

I already tried this method a couple of times that the bad trades also known as 'dangling' had kept on accumulating into huge losses more than the profit that has been collected.

If you are still one among those forex traders who does not implement stop loss on their trading strategy then you won't be able to stay in the market for a very long period of time.

Basing your decision on other trader's own speculation is a very bad idea. So as subscribing into those alert signals that tells you exactly when to enter your trades and when to get out. I had to admit that I already had bad experiences with them when I was just starting out as a forex trader.

This method require huge amount of capital and there are only few brokers that features free-interest. Other than that, brokers are now aware of this strategy that when you are caught using it they might close your account.

2. Grid Trading Strategy

Grid trading is a strategy where the method is to setup multiple orders on different levels of prices. As an example you will be setting up pending orders with distant prices of 10, 20, 30 and so on... Since the forex market always moves back and fort - chances are, some of those triggered orders will be in profit. All you have to do is to re-setup all orders that has triggered their target profit.

I already tried this method a couple of times that the bad trades also known as 'dangling' had kept on accumulating into huge losses more than the profit that has been collected.

A Good Trading Plan Always Comes with Stop Loss

If you are still one among those forex traders who does not implement stop loss on their trading strategy then you won't be able to stay in the market for a very long period of time.

Basing your decision on other trader's own speculation is a very bad idea. So as subscribing into those alert signals that tells you exactly when to enter your trades and when to get out. I had to admit that I already had bad experiences with them when I was just starting out as a forex trader.

One issue was when they kept on telling me that the trend will soon reverse. My position had almost eaten my margin that if the trend still goes in the wrong direction, I will get a 'margin call'.

Just to maintain my position alive, I decided to deposit more money into my broker. As a result, the trend still continued in the opposite direction until it finally cleaned my account. Thus, a good trading plan must always have a stop loss.

Just to maintain my position alive, I decided to deposit more money into my broker. As a result, the trend still continued in the opposite direction until it finally cleaned my account. Thus, a good trading plan must always have a stop loss.

Understanding Bad Trades

A bad trade is simply a trade that doesn't work out in your favor. This could mean that you bought a currency pair at a high price, only to see it drop significantly, or that you sold a currency pair at a low price, only to see it increase in value.

The main problem with bad trades is that traders often hold onto them for too long, hoping that the market will turn in their favor. Unfortunately, this approach often leads to even bigger losses.

One reason traders hold onto bad trades is that they become emotionally attached to them. They might believe that the trade will eventually work out, or that they can't afford to take a loss. However, holding onto a bad trade can be extremely detrimental to your trading account, as it ties up your capital and prevents you from making other, potentially profitable trades.

Common Causes of Bad Trades

There are a number of reasons why traders end up with bad trades. One of the most common causes is overtrading and impulsivity. Traders who are constantly making trades without a clear strategy or plan are more likely to end up with bad trades. This is because they are not taking the time to analyze the market and make informed decisions.

Another common cause of bad trades is a lack of discipline and strategy. Traders who do not have a well-defined trading plan are more likely to make impulsive decisions or to hold onto trades for too long. It's important to have a clear strategy in place before entering the market, so that you can make informed decisions based on your goals and risk tolerance.

Emotional attachment is also a common cause of bad trades. Traders might become emotionally attached to a trade because they have invested a lot of time and effort into analyzing it, or because they have a personal connection to the currency pair. However, emotional attachment can cloud your judgment and prevent you from making rational decisions.

How to Identify a Bad Trade

One of the keys to avoiding bad trades is being able to identify them early on.

There are a number of signs that a trade might be going bad, including:

- The currency pair is moving against your position

- The market is not behaving as you expected

- Your stop-loss order has been triggered

- You are experiencing a high level of anxiety or stress

When you notice these signs, it's important to take action. One option is to cut your losses and exit the trade. This can be a difficult decision to make, especially if you have invested a lot of time and effort into analyzing the trade. However, cutting your losses early can prevent even bigger losses down the line.

There are also a number of tools and resources that can help you identify bad trades. Technical analysis tools like moving averages and support and resistance levels can help you to identify trends and potential entry and exit points. Fundamental analysis tools like economic calendars and news feeds can help you to stay up-to-date with important events that could impact the market.

Avoiding Bad Trades

The best way to avoid bad trades is to have a well-defined trading plan in place. This plan should include clear entry and exit points, as well as risk management strategies like stop-loss orders and position sizing. By having a plan in place, you can make informed decisions based on your goals and risk tolerance, rather than reacting impulsively to market movements.

Risk management is also a key component of avoiding bad trades. This means setting a maximum amount of capital that you are willing to risk on each trade, and sticking to this limit. It's also important to use stop-loss orders to limit your potential losses if the market moves against you.

In addition to having a plan and managing risk, it's important to develop discipline in your trading. This means being patient and waiting for the right opportunities, rather than constantly making trades just to be active in the market. It also means being able to cut your losses when necessary, rather than holding onto a bad trade in the hopes that it will turn around.

Dealing with Bad Trades

Despite your best efforts, it's possible that you will end up with a bad trade at some point. When this happens, it's important to take action to minimize your losses and turn the experience into a learning opportunity.

One strategy for managing a bad trade is to scale out of your position. This means gradually reducing the size of your position as the market moves against you. This can help to limit your potential losses and preserve your capital for future trades.

Another strategy is to use a trailing stop-loss order. This is an order that is placed a certain distance away from the current market price, and that moves up or down as the market moves in your favor or against you. This can help to limit your potential losses while still allowing you to take advantage of any potential gains.

Finally, it's important to view bad trades as learning opportunities. Take the time to analyze what went wrong with the trade, and use this information to improve your trading strategy going forward. This might mean adjusting your risk management strategies, re-evaluating your analysis methods, or simply learning to be more disciplined in your trading.

Conclusion

Holding onto bad trades can be a costly mistake for Forex traders. It's important to understand the potential risks and consequences of holding onto a bad trade, and to develop strategies for avoiding and managing these situations.

By having a well-defined trading plan, managing risk, and developing discipline in your trading, you can minimize your losses and increase your chances of success in the Forex market. Remember that bad trades can also be valuable learning opportunities, and use these experiences to improve your trading strategy going forward.