Retracements are a common occurrence in financial markets and can provide traders with a great opportunity to make sell or short orders. In this blog post, we'll explore what retracements are, how to identify them, and the strategies involved in making sell or short orders from retracements.

Retracements are a temporary reversal in the direction of an asset's price movement. They occur when the asset's price moves in a direction opposite to the trend before resuming its original trend. For example, if a stock is on an uptrend, it may experience a brief period of downward movement before continuing to rise again.

Making sell or short orders from retracements can be a profitable strategy if done correctly. However, it's important to understand the risks involved and have a solid trading plan in place. Let's dive deeper into the world of retracements.

Understanding Retracements

Retracements are a common occurrence in financial markets, and understanding what they are and how they are formed is crucial in identifying potential sell or short opportunities.

A retracement is a temporary reversal in the direction of an asset's price movement. They occur when the asset's price moves in a direction opposite to the trend before resuming its original trend. For example, if a stock is on an uptrend, it may experience a brief period of downward movement before continuing to rise again.

Retracements are typically caused by a combination of profit-taking and market sentiment. When an asset's price has been rising for an extended period, traders may take profits by selling their shares, causing a temporary drop in the price. This profit-taking can be triggered by a variety of factors, such as news events or technical indicators.

Retracements can also be caused by changes in market sentiment. If the market is bullish, and there is a sudden shift in sentiment, traders may begin selling their shares, causing a temporary drop in the asset's price.

There are several types of retracements, including Fibonacci retracements, price channel retracements, and time retracements.

Fibonacci retracements are the most commonly used type of retracements. They are based on the Fibonacci sequence, a mathematical sequence in which each number is the sum of the two preceding numbers. Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels of 23.6%, 38.2%, 50%, 61.8%, and 100%.

Price channel retracements are based on the concept of support and resistance. A price channel is a range in which an asset's price moves, with support at the lower end of the range and resistance at the upper end. When the asset's price moves outside of the channel, it may experience a retracement back to the channel's support or resistance level.

Time retracements are based on the idea that trends repeat themselves over time. They are often used in conjunction with other technical indicators to identify potential areas of support or resistance.

Identifying Potential Sell or Short Opportunities

Identifying potential sell or short opportunities from retracements requires a combination of technical analysis and market knowledge.

The first step in identifying potential sell or short opportunities is to identify the retracement. This can be done by looking for a period of price movement in the opposite direction to the trend, followed by a resumption of the original trend.

Once the retracement has been identified, traders can look for potential resistance levels. Resistance levels are areas where the asset's price has previously struggled to move past. These levels can be identified by looking at previous highs and lows or by using technical indicators such as moving averages or trend lines.

Traders can also use technical indicators to confirm the retracement. For example, if the asset's price is above its 200-day moving average, and the moving average is sloping upward, it may indicate that the asset is on an uptrend. However, if the price drops below the moving average, it may indicate a retracement.

Another useful tool for identifying potential sell or short opportunities is the Relative Strength Index (RSI). The RSI is a momentum indicator that measures the strength of an asset's price movement. It ranges from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions.

When using the RSI to identify potential sell or short opportunities, traders should look for readings above 70 followed by a drop below 70, indicating a potential retracement.

Making the Sell or Short Order

Once a potential sell or short opportunity has been identified, traders can make a sell or short order. The process for making a sell or short order is similar to buying an asset, with a few key differences.

When making a sell or short order, traders must specify the quantity they wish to sell and the price at which they want to sell. They must also specify whether they want to place a market order or a limit order.

A market order is an order to sell the asset immediately at the current market price. This type of order is useful when traders want to sell the asset quickly and are willing to accept the current market price.

A limit order is an order to sell the asset at a specific price or better. This type of order is useful when traders want to sell the asset at a specific price and are willing to wait for the price to reach that level.

When making a sell or short order, traders should also consider setting stop loss and take profit levels. A stop loss is a predetermined level at which traders will exit the trade if the asset's price moves against them. A take profit level is a predetermined level at which traders will exit the trade if the asset's price reaches their target.

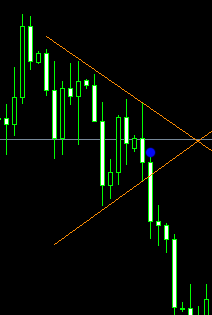

On the example shown below, there are 4 numbers that plays an important role on this retracement strategy. Number 1 is where the price starts. On this case the market condition is bearish or going down. From point 1 it moves to point 2. You will notice that in point 2, the candlesticks had bounced up due to a support line which then formed point 3. Point 3 is what exactly we have been waiting for because its where the retracement will be formed.

Take a closer look into our example once more. You should notice the small white dot on top of the third candle from point 3. At that level, you should enter your SELL or SHORT order exactly by the time that the third candle show up.

Where to put the stop loss?

Look again into our example above until you see the orange-horizontal line. That will be the level of your stop-loss. Always provide some slight allowance to the highest price of the highest retracement candle.

What about the target profit?

Point 4 clearly indicates the level where you should be putting your TP or target profit.

This ends our discussion about retracement. If there are some part that are still unclear to you, feel free to post them on the comment form provided below or if you want to have a private conversation then you can send your concern on my email which can be found at the bottom of this post.

Take a closer look into our example once more. You should notice the small white dot on top of the third candle from point 3. At that level, you should enter your SELL or SHORT order exactly by the time that the third candle show up.

Where to put the stop loss?

Look again into our example above until you see the orange-horizontal line. That will be the level of your stop-loss. Always provide some slight allowance to the highest price of the highest retracement candle.

What about the target profit?

Point 4 clearly indicates the level where you should be putting your TP or target profit.

This ends our discussion about retracement. If there are some part that are still unclear to you, feel free to post them on the comment form provided below or if you want to have a private conversation then you can send your concern on my email which can be found at the bottom of this post.

Managing the Trade

Managing the trade is an essential part of making sell or short orders from retracements. Traders must monitor the trade for potential changes in the market and adjust their stop loss and take profit levels as needed.

One way to manage the trade is to move the stop loss level closer to the asset's price as it moves in the trader's favor. This can help minimize potential losses if the asset's price suddenly moves against the trader.

Traders can also adjust their take profit level as the trade progresses. For example, if the asset's price has moved in the trader's favor, they may want to move their take profit level closer to the current market price to lock in profits.

Another important consideration when managing the trade is identifying when to exit the trade. Traders should have a predetermined exit strategy in place before entering the trade, based on their trading plan and risk tolerance.

Risks and Considerations

Making sell or short orders from retracements can be a profitable strategy, but it's essential to understand the risks involved.

One of the main risks associated with making sell or short orders from retracements is that the asset's price may not continue in the trader's favor. If the asset's price resumes its original trend, the trader may incur losses.

To minimize this risk, traders should have a solid trading plan in place and use technical indicators and market knowledge to identify potential sell or short opportunities.

Another risk to consider is that the asset's price may move suddenly and unpredictably, particularly if there is a significant news event or market disruption. Traders should have a stop loss in place to limit potential losses if the asset's price moves against them.

Conclusion

Making sell or short orders from retracements can be a profitable strategy if done correctly. Traders must understand what retracements are, how to identify potential sell or short opportunities, and the risks involved. By using technical indicators, such as moving averages and the Relative Strength Index, traders can increase their chances of success.

Traders should also have a solid trading plan in place and be prepared to manage the trade actively. This includes setting stop loss and take profit levels, adjusting them as the trade progresses, and having a predetermined exit strategy in place.

While there are risks associated with making sell or short orders from retracements, traders can minimize these risks by using proper risk management techniques and having a thorough understanding of the market.

In conclusion, making sell or short orders from retracements can be a profitable strategy for traders. By using technical indicators, having a solid trading plan in place, and managing the trade actively, traders can increase their chances of success.

However, it's important to remember that there are risks involved, and traders must be prepared to manage these risks effectively. With the right knowledge and skills, traders can use retracements to their advantage and make profitable trades in the market.