Bearish pennant in a downtrend is very similar to the previous post entitled, 'Bullish Pennant in An Uptrend - Bullish'. However, their only difference is that bearish pennant pattern only occurs during the downtrend condition of the forex market. You have to know that once you encountered this trading pattern on your chart, it gives you the confidence of making a profit by going SHORT or SELL.

For those who haven't read the previous post, you can draw the bearish pennant pattern based on the support and resistance lines. Wait, how to you draw the support and resistance lines? Everything has been clearly discussed on this post, 'Support and Resistance Levels'.

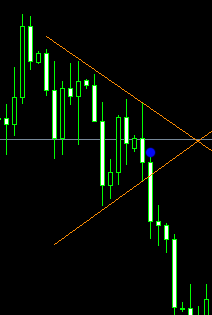

Below is a figure that clearly illustrate how a bearish trend form a bearish pennant pattern:

The figure above shows that the trend has been constricted by the triangle until right into the near end of its corner where the breakout occurred at the support line. You can see that the trend from the figure had bounced twice on the resistance and support lines. This doesn't mean that the pattern must do the exactly the same on your trade. What's important is that a triangle has been formed.

For a better and actual example, here's a screen-shot that I have taken from my Meta-Trader platform:

Example 1: On this first example, the resistance line has been clearly formed by the multiple candles while the support line was formed by a single bounce then followed by a break-through on its second attempt. If you look closer, you will notice the small blue colored dot. That was my entry level for this trade.

Example 2: This is a bearish pennant pattern that was formed on the daily chart of USD/CHF. Just like from the example above, my entry was indicated by the tiny blue colored dot.

Now that you have learned how to plot and interpret a bearish pennant pattern, it doesn't mean that you can already implement it on your actual trades. Applying it the proper way may take time as bearish pennant patterns doesn't often occur. Thus, its best to apply it first on your practice account.

If you want, you can also perform a 'back test' as to how many bearish pennant had occurred on the daily time frame for the whole period of one year. Moreover, if there are something that seems unclear to you about this discussion then feel free to ask them on the comment form provided below.

For those who haven't read the previous post, you can draw the bearish pennant pattern based on the support and resistance lines. Wait, how to you draw the support and resistance lines? Everything has been clearly discussed on this post, 'Support and Resistance Levels'.

Below is a figure that clearly illustrate how a bearish trend form a bearish pennant pattern:

The figure above shows that the trend has been constricted by the triangle until right into the near end of its corner where the breakout occurred at the support line. You can see that the trend from the figure had bounced twice on the resistance and support lines. This doesn't mean that the pattern must do the exactly the same on your trade. What's important is that a triangle has been formed.

For a better and actual example, here's a screen-shot that I have taken from my Meta-Trader platform:

Example 1: On this first example, the resistance line has been clearly formed by the multiple candles while the support line was formed by a single bounce then followed by a break-through on its second attempt. If you look closer, you will notice the small blue colored dot. That was my entry level for this trade.

Example 2: This is a bearish pennant pattern that was formed on the daily chart of USD/CHF. Just like from the example above, my entry was indicated by the tiny blue colored dot.

The Proper Way to Use the Bearish Pennant Pattern

Now that you have learned how to plot and interpret a bearish pennant pattern, it doesn't mean that you can already implement it on your actual trades. Applying it the proper way may take time as bearish pennant patterns doesn't often occur. Thus, its best to apply it first on your practice account.

If you want, you can also perform a 'back test' as to how many bearish pennant had occurred on the daily time frame for the whole period of one year. Moreover, if there are something that seems unclear to you about this discussion then feel free to ask them on the comment form provided below.

No comments:

Post a Comment